In Part 1, we will introduce how to transfer your key levels from a daily chart to an execution chart (typically 5-minute chart) and start to form a strategy in recognizing ranges of support and resistance.

In Part 2, we will follow up with a specific strategy on how a trader can potentially take advantage of said ranges consistently.

Key levels can be combined with the trend and a trader’s situational awareness of the market to create powerful trading setups.

Recognizing key levels:

When looking for key levels, the obvious is the biggest factor in my opinion. I’ve had to learn to stop trying to be the hero who sees what no one else can see, and just rely on what the charts are showing.

Sometimes overthinking the market and trying to discover hidden secrets no one else can see can be a misleading scavenger hunt (Often traders question and hope to discover what the ‘big guys’ are looking for, when in reality the majority of answers to that question is right in front of them on a candlestick chart).

If you rely on the obvious, then you group yourself with other traders who may be making the same decisions in the same area- thereby increasing the percentage of your trade.

6 Things FNL members Rob and Lydean look for to define key levels:

1. Swing highs and swing lows

2. Multiple rejections in a range

3. Find the ‘obvious’ levels- don’t overthink it

4. How does price react at the level? Does it move away drastically?

5. Find levels that act as both support and resistance

6. How recently was the level respected?

You can read their blog on the FNL website (Rob/Lydean support/resistance blog)

First thing to note- when I draw key levels, I use a range encompassing the bodies to wicks from the initial hold of the level to give me a clearer picture of any given level.

Bodies to wicks:

-If support level - Draw a box from the lowermost body in the support area down to the lowest wick.

-If resistance level - Draw a box from the uppermost body to the highest wick in the turnaround.

This box gives me an accurate range of expectation for the next time the market returns to the level.

Expectation - means I have to wait to confirm the key level is being held.

Examples of finding and drawing a key level

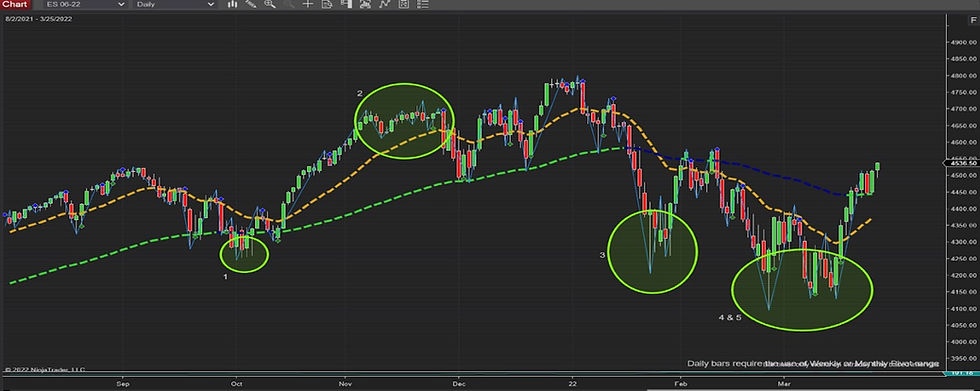

Below is a blank Daily ES chart- where might you see key levels? Look for obvious highs and lows and places of strong rejection.

A few Key levels circled and noted before drawing support/resistance zones

Boxing key levels (before extending)

Level 1 - Oct 2021 (red)- 4275.50 to 4245.50

Level 2 - Nov-Dec 2021 (orange)- 4697 – 4680.25

Level 3 - Jan 2022 (green)- 4301.50 – 4205.75

Level 4 - Feb- March 2022 - (blue) - 4208- 4095

Level 5 - Feb-March 2022 - (purple) - 4145.75 – 4131.50.

All of these levels are within a couple points of the exact number. The MES may have slightly different values, but the same concept holds true on either chart.

Feel free to draw these levels on your own charts and examine how the market respects them into the future or from other time frames such as a 5 minute chart.

You may find other additional key levels from the daily; I marked a few obvious ones.

Don’t trust me- practice for yourself and decide what works for you.

Levels Found- Moving Forward

Once we have found our Key Levels on the daily chart, we want to apply those levels to our trade execution chart. Typically a 5 minute or 15 minute chart.

Two main differences when using key levels are whether you are continuing to trade in the direction of the trend, or if you are assuming a key level will hold as a reversal. Over time I’ve learned to prefer trading levels with the trend more than against it, but both have their place in the trading world.

Whether trading with the trend or trading a reversal, I still want to confirm the market is turning at my key level. The best way I’ve learned to do that is to wait for a turnaround or key indecision symbol at the key level.

This may come in the form of a FNL Diamond, a Double Bar (DB), or a set of candles showing strong respect for a level (this set almost always includes a DB from the key level as well).

The next step is taking the key boxes drawn and applying them to all your charts (or at least the execution chart), then looking for a trade.

A quick way of extending boxes and applying them to all charts on NinjaTrader is as follows:

-Draw the box using NinjaTrader’s draw tool - ‘Rectangle’

-Either right click and pull up properties or double-click on the box to get the settings window

- Select the dropdown from ‘Attach to’ and choose ‘All charts’

- Select the dropdown for ‘End time’ of the rectangle and extend beyond the current date

Example of rectangle settings to extend on NinjaTrader

Here is an example of a Daily Chart with all boxes extended to a specific time chosen (as shown above)

Ok, now I have huge boxes on my daily….What will I be looking for on my 5-min chart? What does this do for my actual trading?

Notice how you can already see support/resistance in a couple of these areas - the most obvious might be how:

-The red box holds as support through early February

-The orange box showed a range that the market had serious trouble closing above before resisting back down

-The blue and purple show the lowermost area of support before we had a strong upward move out of that area

Zooming in:

Now let’s match these key levels with the 5-min execution chart and find a balance between what the 5-min chart is showing and the key levels of support/resistance.

I have zoomed in to a couple areas, but you may notice on your own charts there are many other areas the market respects the same key levels.

2 common expectations are created by the support/resistance levels:

1. Either the trend will continue through the key level, but come back to retest what was resistance as support, or vice versa.

2. Or, the market will reject from the key level and the key level will be a reversal point on the trend

Again these are expectations - nothing is 100%. We are seeking the scenario in which we have an advantage in the trade.

Non-artistic drawing for reference using the orange box as a hypothetical level :)

I would highly recommend you apply these levels on your own charts and see how the levels are respected and how you perceive the levels.

Our goal is for you to examine how the boxes and levels show support and resistance over time, and how you can implement them into your trading.

Be sure to engage in our trading sessions and share your thoughts!

Stay tuned for Part 2 on how to trade these key levels!!

Comments